Growing our capacity in food and beverage manufacturing

By Darren Sperling and Frank Melo

Custom steel buildings are a wise component in increasing production to create value and food stability in an industry fraught with emerging challenges.

Food security is an increasingly pressing issue worldwide, with the agricultural and food processing industries facing significant headwinds. Challenges, ranging from labour shortages to inflation and the need for innovative solutions, are prompting both independent enterprises and governments to seek new strategies to ensure reliable and sustainable food systems.

As one of Canada’s largest and most important sectors, food production stands at the forefront of potential solutions, offering promising innovation to improve the food security and sustainability. Just imagine producing more food at a local level, delivering fresher, more nutritious food with less processing and fewer preservatives. As a world-leader, we are seeing advances being made in increased automation, vertical agriculture, and a focus on engaging younger workers who are more comfortable with technology. These are but a few of the novel approaches designed to address the complexities of food production and distribution.

Producing food to feed a growing global population demands considerable resources, including space, time, and care. While efforts to reduce food waste and optimize production are essential, the fundamental challenge remains: meeting the increasing demand for food. This challenge is not new; however, technology and an entrepreneurial mindset are helping to transform the industry by working with traditional farm operations and suppliers to improve the yield per acre.

At the forefront of combining food production with modern technology are pre-engineered steel buildings that create larger and more durable spaces for raw materials, processing and packaging. Metal structures require less maintenance and are less expensive to operate. Summit Steel Buildings’ custom-made food and beverage manufacturing structures can help increase your operations,

while maintaining a hygienic and easy-to-clean environment.

Quick review of the Canadian food and beverage manufacturing industry

The food and beverage industry is already huge. It is one of the largest manufacturing sectors in the Canadian economy and is only expected to grow. With exports reaching record values and a positive trade balance, the industry's importance extends beyond domestic consumption. However, sustaining growth and competitiveness require ongoing innovation, investment, and adaptation to evolving consumer preferences and market dynamics. [Source for data: Agriculture Canada]

- In 2022, the food and beverage processing industry was the largest manufacturing industry in Canada in terms of value of production with sales of goods manufactured worth $156.5 billion; it accounted for 18.2% of total manufacturing sales and for 1.7% of the national Gross Domestic Product (GDP). It's also the largest manufacturing employer and provides employment for 300,000 Canadians.

- Sales for Canada’s food and beverage sector were forecast to surpass $164 billion in 2023, exceeding initial projections by 3.2 per cent. [Source: Farm Credit Canada]

- The domestic sector supplies approximately 70% of all processed food and beverage products available in Canada and is the largest buyer of agricultural production.

- The largest food and beverage processing industry is meat product manufacturing with sales of $38.5 billion in 2022 and accounting for 25 per cent of sales. Grain and oilseed milling is the second largest industry with sales of $20.3 billion, followed by dairy product manufacturing with sales of $17.4 billion.

- Other industries include:

- other food manufacturing ($16.4 billion)

- bakeries and tortilla manufacturing ($16 billion)

- beverage manufacturing ($14.9 billion) – including soft drinks, breweries, wineries and distilleries

- animal food manufacturing ($11.9 billion)

- fruit and vegetable preserving, and specialty food manufacturing ($10.1 billion)

- seafood product preparation and packaging ($5.9 billion)

- sugar and confectionery product manufacturing ($5.2 billion)

- Ontario and Quebec account for most of the production with approximately 60% of sales, British Columbia and Alberta account for 24% and the remaining provinces, over 16%.

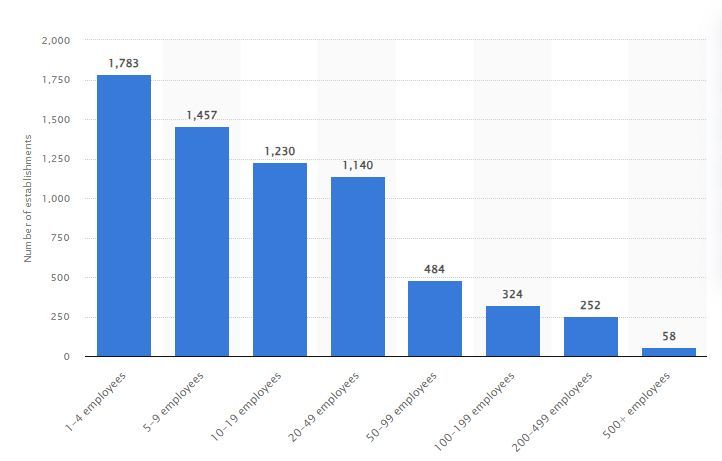

Number of food manufacturing establishments in Canada as of December 2022, by employment size

Source: Statistics Canada, statcan.gc.ca, as of Dec. 2022, courtesy of Nils-Gerrit Wunsch, Statista, Feb. 16, 2024.

Industry challenges

As expansive as the food and beverage manufacturing industry is, it continues to be a mix of large dominant players and many smaller enterprises employing fewer than 50 employees. Food manufacturing operations with more than 500 employees constitute less than one percent of all companies (0.86%). Smaller organizations (under 50 employees, making up 83.38% of the industry) may not necessarily have the capital to invest in automated equipment and large-scale production capacity, while larger operations have been slow to modernize or replace older equipment and processes. As such, food processing can sometimes be outdated and inefficient. This is just a start to some of the other issues affecting the industry.

Population growth and agricultural capacity…

Growing food and raising livestock requires a great deal of space, time, resources and care. While programs to reduce food waste and ensure everything we grow is put to good use are valuable, producing more food to feed an ever-growing population has been, and will always be, a huge problem.

The challenges of producing enough food for a hungry population is not new; it has been observed for centuries. Thomas Malthus, an 18th century economist and author of “An Essay on the Principle of Population”, was an early observer of the dilemma that successful food production creates. He recognized the tendency for improvements in food production to stimulate population growth, ultimately negating gains in per capita food availability.

An increase in a nation's food production improves the well-being of the population, but the improvement is only temporary because it leads to population growth, which in turn restores the original per capita production level. In other words, humans have a propensity to use abundance for population growth rather than for maintaining a high standard of living.

These factors place unrelenting pressure on both agriculture and manufacturers to produce more from fixed constraints (such as amount of available land dedicated to crops, acreage yields and limits to how much food can be produced in existing factories in a set period).

Inflation…

In more modern times, the high cost of real estate, transportation, supply chain issues and retail operations (leading to higher markups) has led to an extraordinary level of food inflation (while packaging strategies to meet margins introduced consumers to the concept of shrinkflation).

The 2024 Canada’s Food Price Report, from research partners at Dalhousie University, the University of Guelph, the University of Saskatchewan and the University of British Columbia, forecasts that overall food prices will continue to increase, but by less than in 2023. Food prices will likely rise by 2.5% to 4.5% (compared to 5% to 7% in 2023). The average family of four is expected to spend $16,297.20 on food in 2024, an increase of up to $701.79 from last year (compared to an increase of $1,065 in 2023). [Source: Dalhousie University]

We’ve seen an increasing level of frustration Canadians have had with grocers as their profits climbed and food inflation wreaked havoc on family incomes - peaking at 11.4% before easing over the past year. [Source: CTV News]

There’s no question, consumers face higher prices at the checkout; and it’s not any easier for food suppliers and manufacturers. They continue to face labour shortages and strong wage pressures. At the same time, “a decline in consumer spending caused by inflation is putting pressure on food and beverage margins, which have been compressed since 2019. For the beverage industry, gross margins are nearly 50% lower. In the food sector, margins are on average 11% below the pre-pandemic level.” [Source: Farm Credit Canada]

Inflation, coupled with rising costs of land, transportation, and retail operations, has contributed to soaring food prices. Inflation trends underscore the persistent challenge of balancing food affordability with sustainable production practices.

Technology and food equipment…

The landscape of food production and distribution continues to evolve significantly, marked by technological advancements and economic shifts. Robotics and automation are emerging as potential solutions to alleviate manual processes to offer opportunities to enhance productivity, reduce labour dependency, and improve overall efficiency.

Robotic applications in the food and beverage industry offer tangible benefits across various stages of production and packaging. From case erectors that streamline box assembly to case packers and palletizers that optimize packaging processes, automation technologies promise to revolutionize food manufacturing. These innovations not only improve operational efficiency but also mitigate the impact of rising costs on profit margins.

As more equipment becomes commonplace for successful operations, renting ill-suited and expensive commercial spaces or trying to retrofit former industrial locations won’t create optimal environments for food and beverage manufacturing. It makes much more sense to build-to-suit with a custom-designed steel facility that is cheaper to clean and maintain and much more hygienic for food production and storage. Pre-engineered steel components protect against mold, bacteria and pests with simple cleaning.

For less than renting, you can get an ideal facility for your current and future business needs, complete with all the proper electrical, drainage and environmental systems to manage your growing business of food and beverage making.

Creating solutions for future of food and beverage production begins with steel

Despite all the existing and emerging industry challenges, the food and beverage sector in Canada has experienced notable growth, surpassing projections. It’ll continue to be a critically important contributor to food stability and our economy. Addressing the needs of the future food industry requires a concerted effort from stakeholders across the value chain. Innovation, technological advancement and strategic partnerships can pave the way for a more resilient and sustainable food system. By embracing automation, leveraging emerging technologies, and prioritizing consumer trust, the food industry can navigate current problems and pave the way for future growth and prosperity.

Part of this growth is providing modern facilities equipped to handle the needs of more efficient operations. New, larger and better buildings mean more production and better customer service. Intelligently investing in capital assets to expand your operational space pays off for today’s needs as well as for any future expansion.

When you’re ready,

contact our team at Summit Steel Buildings. We're excited to learn more about your food or beverage business and how we can provide you with a custom building solution suited for your future needs. Call us at

877-417-8335 or email us at

info@summitsteelbuildings.com for a free quote and to receive your preliminary drawings.

About the authors:

Darren Sperling has specialized in the engineering and delivery of pre-engineered steel buildings for over 17 years and has experience in over 20 countries worldwide. Contact him at (877) 417-8335, by email at darren.sperling@summitsteelbuildings.com or on LinkedIn.

Frank Melo has a construction civil engineering technology and business background with over 25 years of experience as a business owner and contractor. He was born and educated in London, Ontario and now divides his time between projects primarily in Ontario and British Columbia. He can be contacted at Summit Steel Buildings at

(778) 951-4766 or by email at

frank.melo@summitsteelbuildings.com or through

LinkedIn.